In many societies, owning a vehicle is not only a result of necessity, but also a symbol of luxury and class. This is why automobile sales have skyrocketed across the world in the last decade, especially in developing economies. As such countries are experiencing economic prosperity, the disposable income is rising, encouraging consumers to purchase things, which were earlier unaffordable, such as vehicles. Apart from private transport, vehicles are also used for mass transit, military transportation, and freight moving, the rate of all of which is rising. As the demand for automobiles is growing, manufacturers are increasing their production volumes, which is leading to an ever-increasing consumption of automotive components and materials, such as paints and coatings.

Get the sample copy of the market insights: https://www.psmarketresearch.com/market-analysis/automotive-oem-coatings-market/report-sample

In 2018, the automotive original equipment manufacturer (OEM) coatings market valued $10,997.4 million, and it is predicted to reach $13,661.4 million by 2024. Other than serving the all-important purpose of aesthetics, coatings also protect vehicles from minute damages caused by road bumps, heat, ultraviolet light, hail, scratches, and snow. With advancements in all aspects of automobiles, the key trend in paints is the development of coatings in the powder form. Such coatings emit almost negligible volatile organic compounds, unlike their liquid counterparts, which make them compliant with the environmental policies of numerous countries.

A key driver, as mentioned above, for the growth in demand for automotive coatings is the expansion of the global automobile industry. Nations including Thailand, India,the Philippines, Indonesia,and South Korea display immense potential, as far as the two- and four-wheeler sales are concerned. The tier-II and tier-III cities in these countries are witnessing rapid urbanization and increase in the disposable income, which is expected to raise personal vehicle adoption here. With improvements in road connectivity in rural and semi-urban areas, automobile sales are expected to rise further, in turn, leading to an increased consumption of OEM coatings.

Coatings are applied to metal as well as plastic parts of automobiles, of which metal parts accounted for the higher application of such materials during 2014¬¬–2018. This is because of the simple reason that the majority of the automobile parts are made of metal. Of the two major types of end users, based on the type of vehicles they manufacture — light and commercial — light vehicle OEMs consumed the higher amount of coatings during the historical period, and they are expected to maintain their dominance on the market in the future.

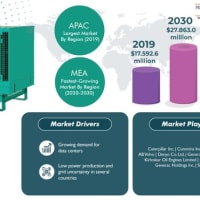

The automotive OEM Coatings market growth is predicted to be the most significant in Asia-Pacific (APAC). This is because India, China, and Japan are three of the largest automobile markets globally. A large number of auto giants are based in APAC, such as Toyota, Hyundai, Nissan, and Suzuki; further, the region is also home to the manufacturing plants of European and North American automakers, including Ford, BMW, Volkswagen, and Daimler. Additionally, several non-APAC automakers are signing pacts with regional OEMs for automobile production. For instance, in April 2017, Volkswagen signed an agreement with India-based Tata Motors to manufacture vehicles for India and other nations.

It is developments like these, which would lead to an even higher automobile production in APAC, which would, in turn, result in a rising demand for OEM coatings.

Get the sample copy of the market insights: https://www.psmarketresearch.com/market-analysis/automotive-oem-coatings-market/report-sample

In 2018, the automotive original equipment manufacturer (OEM) coatings market valued $10,997.4 million, and it is predicted to reach $13,661.4 million by 2024. Other than serving the all-important purpose of aesthetics, coatings also protect vehicles from minute damages caused by road bumps, heat, ultraviolet light, hail, scratches, and snow. With advancements in all aspects of automobiles, the key trend in paints is the development of coatings in the powder form. Such coatings emit almost negligible volatile organic compounds, unlike their liquid counterparts, which make them compliant with the environmental policies of numerous countries.

A key driver, as mentioned above, for the growth in demand for automotive coatings is the expansion of the global automobile industry. Nations including Thailand, India,the Philippines, Indonesia,and South Korea display immense potential, as far as the two- and four-wheeler sales are concerned. The tier-II and tier-III cities in these countries are witnessing rapid urbanization and increase in the disposable income, which is expected to raise personal vehicle adoption here. With improvements in road connectivity in rural and semi-urban areas, automobile sales are expected to rise further, in turn, leading to an increased consumption of OEM coatings.

Coatings are applied to metal as well as plastic parts of automobiles, of which metal parts accounted for the higher application of such materials during 2014¬¬–2018. This is because of the simple reason that the majority of the automobile parts are made of metal. Of the two major types of end users, based on the type of vehicles they manufacture — light and commercial — light vehicle OEMs consumed the higher amount of coatings during the historical period, and they are expected to maintain their dominance on the market in the future.

The automotive OEM Coatings market growth is predicted to be the most significant in Asia-Pacific (APAC). This is because India, China, and Japan are three of the largest automobile markets globally. A large number of auto giants are based in APAC, such as Toyota, Hyundai, Nissan, and Suzuki; further, the region is also home to the manufacturing plants of European and North American automakers, including Ford, BMW, Volkswagen, and Daimler. Additionally, several non-APAC automakers are signing pacts with regional OEMs for automobile production. For instance, in April 2017, Volkswagen signed an agreement with India-based Tata Motors to manufacture vehicles for India and other nations.

It is developments like these, which would lead to an even higher automobile production in APAC, which would, in turn, result in a rising demand for OEM coatings.

※コメント投稿者のブログIDはブログ作成者のみに通知されます