The rapid industrialization and increasing construction activities in the Eastern European and Asia-Pacific (APAC) countries are some of the major factors fueling the demand for alumina across the world. The swift economic growth of these countries is primarily responsible for the sharp surge in construction activities and infrastructural development projects. Moreover, the growth of the construction industry has boosted the demand for various high-quality products such as cement, glass, and specialty steel, which has, in turn, created a huge requirement of alumina in the country. This is because of the extensive usage of this material in steel manufacturing processes.

The European Union (EU) and the U.S. have recently enacted legislations for boosting the domestic production of LCDs (liquid crystal displays) to cater to the rising demand for locally manufactured flexible, high-precision, and larger-panel LCD TVs. This is another factor driving the sales of alumina around the world. Apart from this, alumina is also being increasingly required in the production of stationary energy storage devices like lithium-ion batteries and gas turbines and as a base material in the packaging, consumer durables, automotive, and electrical and electronics industries.

Get a sample copy of this report:

https://www.psmarketresearch.com/market-analysis/alumina-market/report-sample

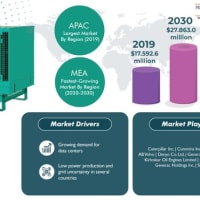

Due to the aforementioned factors and the declining prices of alumina, the value of the global alumina market is predicted to decrease from $61,093.4 million to $54,907.3 million from 2018 to 2024. However, the market will exhibit rapid volumetric advancement in the future years, progressing at a CAGR of 3.0% from 2019 to 2024. The most commonly used types of alumina are reactive, fused, calcined, metallurgical, and tabular. Amongst these, the usage of the metallurgical alumina was observed to be the highest in the last few years.

Geographically, the alumina market registered the highest growth in the Asia-Pacific (APAC) region during the last several years and this trend will continue in the upcoming years as well, as per the predictions of the market research company, P&S Intelligence. This is attributed to the surging alumina manufacturing capacities of India, Indonesia, and China. According to the data published in the British Geological Survey’s World Mineral Production 2013–2017, the production of alumina in these countries accounted for more than 58.0% of the total alumina produced in the world in 2017.

The European Union (EU) and the U.S. have recently enacted legislations for boosting the domestic production of LCDs (liquid crystal displays) to cater to the rising demand for locally manufactured flexible, high-precision, and larger-panel LCD TVs. This is another factor driving the sales of alumina around the world. Apart from this, alumina is also being increasingly required in the production of stationary energy storage devices like lithium-ion batteries and gas turbines and as a base material in the packaging, consumer durables, automotive, and electrical and electronics industries.

Get a sample copy of this report:

https://www.psmarketresearch.com/market-analysis/alumina-market/report-sample

Due to the aforementioned factors and the declining prices of alumina, the value of the global alumina market is predicted to decrease from $61,093.4 million to $54,907.3 million from 2018 to 2024. However, the market will exhibit rapid volumetric advancement in the future years, progressing at a CAGR of 3.0% from 2019 to 2024. The most commonly used types of alumina are reactive, fused, calcined, metallurgical, and tabular. Amongst these, the usage of the metallurgical alumina was observed to be the highest in the last few years.

Geographically, the alumina market registered the highest growth in the Asia-Pacific (APAC) region during the last several years and this trend will continue in the upcoming years as well, as per the predictions of the market research company, P&S Intelligence. This is attributed to the surging alumina manufacturing capacities of India, Indonesia, and China. According to the data published in the British Geological Survey’s World Mineral Production 2013–2017, the production of alumina in these countries accounted for more than 58.0% of the total alumina produced in the world in 2017.

※コメント投稿者のブログIDはブログ作成者のみに通知されます