A huge amount of mercury has been released into the atmosphere due to the continuous burning of fossil fuels for producing energy. Moreover, mercury emissions across the globe are also increasing because of its utilization in products and industrial processes. It has been estimated that about 2220 metric tons of mercury is emitted each year from anthropogenic sources. Increased exposure to mercury can threaten human lives immensely, often with irreversible toxic effects. Young children and pregnant women are the most at risk, along with which, mercury also negatively affects ecosystems and wildlife. It is due to the increased mercury emissions that the demand for bromine is increasing.

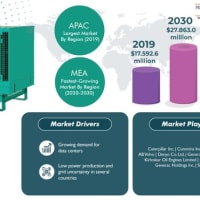

Bromine has the potential to reduce mercury emissions significantly, about 90%. Bromine additives are utilized for converting elemental mercury into oxidized mercury, so that it can be captured easily with emissions control equipment. After this, the retrieved mercury can be handles with care. According to a report by P&S Intelligence, the global bromine market attained a value of $1,864.3 million and is expected to advance at a 5.7% CAGR during the forecast period (2020–2030). The three major derivatives of bromine are organobromide, hydrogen bromide, and bromide salts.

Get a sample copy of this report: https://www.psmarketresearch.com/market-analysis/bromine-market/report-sample

Out of these, the demand for organobromides was the highest in the past, which can primarily be attributed to the extensive consumption of these derivatives, including vinyl bromide, styrene bromide, allyl bromide, ethylene dibromide, and propylene bromide, for the production of catalysts, pesticides, solvents, and intermediates for gasoline antiknock agents, organic synthesis, and fumigants. Apart from this, the demand for bromine salts is also expected to grow considerably in the years to come, owing to the fact that these products are largely being utilized for producing clear brine fluids.

Asia-Pacific (APAC) dominated the bromine market during the historical period (2014–2019), primarily owing to the high production and consumption of these derivatives in China. Seeing the abundance of naturally occurring bromine, cost-effective labor, and consumers, many companies from outside are setting up derivative manufacturing plants in the country. Further, with the rising disposable income of the people as well as swift urbanization in the region, the demand for bromine-based flame retardants, for electronic and plastic products and insulation, is escalating.

To increase their revenue by catering to the rising demand for the gas and its derivatives, bromine market players are radically expanding their manufacturing capacity. For instance, in September 2019, the Industrial Products division of Israel Chemicals Limited announced its intentions to increase the annual production capacity of the gas and its derivatives, such as tetrabromobisphenol A, to around 25,000 tons by 2021.

Similarly, LANXESS AG announced capacity expansion plans for phosphorus- and bromine-based flame retardants, in December 2018, to strengthen its bromine asset base.c

Bromine has the potential to reduce mercury emissions significantly, about 90%. Bromine additives are utilized for converting elemental mercury into oxidized mercury, so that it can be captured easily with emissions control equipment. After this, the retrieved mercury can be handles with care. According to a report by P&S Intelligence, the global bromine market attained a value of $1,864.3 million and is expected to advance at a 5.7% CAGR during the forecast period (2020–2030). The three major derivatives of bromine are organobromide, hydrogen bromide, and bromide salts.

Get a sample copy of this report: https://www.psmarketresearch.com/market-analysis/bromine-market/report-sample

Out of these, the demand for organobromides was the highest in the past, which can primarily be attributed to the extensive consumption of these derivatives, including vinyl bromide, styrene bromide, allyl bromide, ethylene dibromide, and propylene bromide, for the production of catalysts, pesticides, solvents, and intermediates for gasoline antiknock agents, organic synthesis, and fumigants. Apart from this, the demand for bromine salts is also expected to grow considerably in the years to come, owing to the fact that these products are largely being utilized for producing clear brine fluids.

Asia-Pacific (APAC) dominated the bromine market during the historical period (2014–2019), primarily owing to the high production and consumption of these derivatives in China. Seeing the abundance of naturally occurring bromine, cost-effective labor, and consumers, many companies from outside are setting up derivative manufacturing plants in the country. Further, with the rising disposable income of the people as well as swift urbanization in the region, the demand for bromine-based flame retardants, for electronic and plastic products and insulation, is escalating.

To increase their revenue by catering to the rising demand for the gas and its derivatives, bromine market players are radically expanding their manufacturing capacity. For instance, in September 2019, the Industrial Products division of Israel Chemicals Limited announced its intentions to increase the annual production capacity of the gas and its derivatives, such as tetrabromobisphenol A, to around 25,000 tons by 2021.

Similarly, LANXESS AG announced capacity expansion plans for phosphorus- and bromine-based flame retardants, in December 2018, to strengthen its bromine asset base.c

※コメント投稿者のブログIDはブログ作成者のみに通知されます