Data from Bank of Japan shows Japan is in huge disadvantage in global competition relative to US

要約:日本銀行が作成した海外貿易及び対外投資のデータにより、幾つかの深刻な問題が分かる。① 巨額の海外資産は日本に返すべき相応の実利をもたらさないこと。② 国民が作った巨額の富を外国に託すことに大きなリスクを伴うこと。他国の商品とサーヴィスを利用する面において、米国は日本やその他の国より極めて優位に立つ。この優位は国際通貨としての米ドルを濫発することで得たものであり、世界経済からの吸血です。自分が吸血されていなくても、米国のように吸えない国(たとえば日本)は、不利になる。米国は米ドルの濫発をスピードアップさせることで、茹でガエル=世界のための水温を加速的に上げている。米国の優位で正帰還ループができあがり、世界各国の国力の不均衡がますます加重され、深刻でグローバルな脅威になりつつある。世界は緊迫感を持ってこの濫用行為に対処しなければならない。

Abstract: Japan's foreign trade and international investment data from the Bank of Japan reveals serious issues, 1, huge overseas asset has not brought in much benefit for Japan as it should. 2, high risk due to trusting huge national wealth to foreign countries. In contrast, the U.S. has great advantages in the utilization of other countries' goods and services relative to Japan and other countries. This advantage is obtained by abusing US$'s global currency status, and is a blood-sucking from world economy. Even countries who are not sucked themselves but can't suck as US can, such as Japan, are disadvantaged. As US speeds up the dollar printing, it is actually turning up the heat on the world, a boiled frog in warm water. This advantage forms a positive feedback loop and is self-amplifying, and will lead to more and more unbalanced world development, which in turn will pose a major global threat. The world must deal with this abusing with a sense of urgency.

日本語版 、「日銀データは、米国と比べて日本が国際競争で非常に不利にあることを示す」

Japan has the most overseas investment assets in the world. Since Japan has made a huge amount of investment in foreign countries, it is expected that Japan will get the corresponding benefits from it, e.g., a continuous inflow of goods and services imported from foreign countries to Japan. It's like if you put money in the bank then you get interest every year. However, according to the investment data and import & export data provided by the Bank of Japan, this is not the case.

[Chart 1]

[Chart 2]

Let's study the data. The 1st chart is the time series of Japan's net international investment asset value. The 2nd chart is time series of the net value of Japan's import and export. In this chart, if the total export is greater than the total import, the net value is positive, and vice versa. From the point of view of suppliers (the business owners), the more exports the better, so, the higher in the upward direction the value is, the better. From the perspective of consumers (ordinary citizens), the more imports the better, so, the lower in the downward direction the value is, the better. In the end, the best value has to be zero. However, for Japan, the situation is special. As Japan has a lot of investment overseas, there should be a return on these investments, so ideally the net value of export minus import should be at some negative value. The more negative, the higher the return rate of Japan's overseas investment is.

From the chart, we can see that before 2006, Japan had been exporting goods and services (mainly to US), so was a contributor. Since 2006, Japan's imports occasionally exceeded exports by a small amount, meaning Japan began to be a beneficiary. However, in the 15 years from 2006 to 2020, the total of import minus export value is only ¥15 trillion, equivalent to ¥1 trillion net import per year on average. In the past 15 years, Japan's average overseas net assets is ¥300 trillion, this is equivalent to say, that Japan's overseas investment return rate is merely 0.3%. Such a rate of return means that it will take more than 100 years for Japan to take back and make use of all the Japan's overseas investment, which had been accumulated by Japanese people through hard work and saving on expenditure. It's certainly problematic to have such a low utilization efficiency for such a huge amount of resource.

Some people will say, although Japan's effective ROI (return on investment) from its overseas investment is very low, Japan's overseas assets have increased by ~60% in 14 years. 60% looks good, but it's equivalent to an annual growth rate of only 3.5%. If viewed by private investors, it's certainly not good, let alone the negative offset effect of global inflation (Ref. 10, the global average annual rate is ~3%, however, it would be higher if the trade surplus countries had spent all their surplus dollars ) caused by the over-issuing of US dollars.

Some scholars criticized Japan's excessive foreign exchange reserves a long time ago. For example, Taniuchi (谷内満, Professor of Business School of Waseda University) believed that Japan's foreign exchange reserve is too high when compared with other major developed countries, and this is a great risk for Japan, so it should be reduced. Years has passed, his proposal has not been taken seriously and the problem remains.

Contrary to Japan, the net value of overseas investment of the US is negative, and it is the biggest debtor country in the world. However, the US can continuously import a huge amount of goods and services from all over the world by over-issuing new US dollars, and this situation has lasted for some 40 years. "The biggest debtor" sounds terrible, but if US really doesn't like it, how can they let this to last 40 years? On the surface, Americans complain about its trade deficits with other countries every year. but, they could be laughing at the world behind closed door.

Now, let's compare the data of Japan and US. Japan's overseas net assets of about ¥300 trillion only bring in about ¥1 trillion net inflow of goods and services to Japan every year. In contrast, US has more than ¥1000 trillion (~ 10 trillion US dollars) of international debt, but it has ¥50 trillion (~ 500 billion US dollars) of net goods and services inflow (trade deficit) every year. Let me help you to grasp better by way of analog. Suppose you are a big boss. through your hard work, you now own a big company. However, the company only brings in ¥1 million of income for you to live on every year, while your neighbor, although nominally in deep debt, enjoys a living standard of ¥50 million per year. How do you feel in the face of such a situation? On the other hand, imagine, if Japan, like the US, can get US$500-100 billion worth of goods and services from foreign countries every year by printing more paper money, what a huge benefit would it be? And the US has enjoyed this privilege for several decades!

With the support of such huge amount of stolen wealth (ref. 6), the US not only greatly improved the life of its citizens, but also used higher pay to seduce the best talents from all over the world to immigrate to US and serve the US. In this way, the US can invest unmatchable human and material resources in research and development of science, technology and military. If you visit American universities and high-tech companies, you will be surprised to find these places are all like a little United Nation, full of personnel from Russia, China, Eastern Europe and so on. An easy way to verify this status is to just look at the surnames of top renowned American scientists: Katina Kariko (mRNA, covid19 vaccine, Hungarian), Andrew Ng (AI, Chinese), Demis Hassabis (Alpha Go, Cypriots-Chinese), Alisyn Malek (AI, Polish), these names go on and on, and are obviously immigrants.

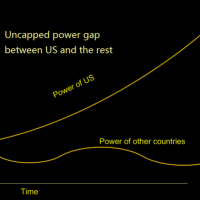

Because of these huge advantages, countries around the world, including Japan, can not or have extreme difficulty to compete against the US. Of course, we must also take into account the long-term cumulative effects of these unfair advantages. If this situation continues for a long time, all countries except the US in the world, including Japan, will be tragically exemplifying the fate of losers in Darwin's theory of evolution.

Alarmingly, the US recently has greatly accelerated the speed of printing new money, and it can be predicted that the speed of the whale-swallowing of global goods and services by US (i.e. its annual trade deficit) will increase accordingly. More and more worrying problems are springing up. For example, the issue of global inflation and the reduction in true value of Japan's foreign currency reserves. One other significant issue, the recent developments in AI, superconductor, laser weapon, nuclear fusion, quantum computing and other fields has made the world into a eve of a new technological revolution, the US has succeeded to seduce the best talents from all around the world, which makes its R&D capability greatly outmatch that of other countries in the world. It can be predicted that these advantages will be transformed into new and bigger technological advantages, military advantages for US.

If the world does not interrupt this trend and let it continues, the accumulated foreign debt of US, or equally, the foreign currency reserves earned by the world from US, will increase from $10 trillions to $20, 30, 40, 50 trillions and so on. What will happen then? Without a doubt that eventually the US dollar will become the real world currency, and every other countries will probably abandon their own currencies. The Bank of America will become the Central Bank of the Earth. At this time all countries of the world will be deeply down in the US dollar trap (ref. 6) and will never be able to get out of it. America can then do whatever to the world at will.

Americans also forces every countries to open their financial markets and stock markets. Since they are the most powerful speculators with the most money, they usually crush local investors and steal quick money from each country (ref. 9). The deep pocket American capitalists hunt for the best companies around the world (ref. 8). All of these have happened in Japan. US uses sanction frequently and recklessly. Its allies often have to sacrifice their own commercial interests to cooperate with America. For example, because of the sanctions against Iran, every Japanese has to spend more money on gasoline.

Every year, US gets foreign goods and services worth of ~US$ 500 billions by running their money printing machine. What a huge and unfair advantage US has enjoyed for decades. I don't understand why so many economists and politicians of so many countries of the world, have been turning a blind eye to such an important issue. Although the trade deficit has squeezed some industries in US and boosted some industries in other countries, but all citizens of US enjoy the foreign goods and services without having to do their own work, while people in other countries have to do extra labor for the enjoyment of Americans. With this privilege, Americans can devote more time and energy to their personal interests and development, US can transfer its resources and labor force to more important fields. such as science, technology and advanced weaponry. In the end, US has been gaining ever greater advantages over all other countries in the world.

One of major goal of America's policies and international activities, a very secret purpose that has never been divulged to the world, is to enable the US to permanently enjoy the right to exploit other countries through US$. This is the so-called US$ trap. Countries that are exploited through US$ by US, threatened by US militarily and suppressed by US bully should reflect hard on their own practices and policies. Even countries that are not directly exploited through US$ by US, should also reflect hard on their own foreign relationship policies and trade policies, since US has gained great competitive edges by exploiting other countries through US$, and if US flooded the markets of your neighbor countries with US$, how can your country keep unaffected? We all need to reflect on the question of whether our country has fallen into the trap of the US, and whether we have been unduly ignoring the seriousness of the US$ exploitation by US, and whether we should have proactively taken measures to reverse the unfavorable competition situation for our countries.

Although the US needs Japan now and regards Japan as an ally, looking back the recent history, the US actually has been mean to Japan (ref. 2), not to mention Trump, which gives Japan a bit of bitter taste of serving the emperor of the world. If the gap between the comprehensive national power of US and Japan gets too big in the future, or US no longer needs Japan, what will US do to Japan? The world situation changes year by year, but the human characters of the people who make policy decisions is an anchor based on which we can make predictions. Let's examine the human characters of American politicians by looking at what they have been doing. The US often uses force on foreign countries, and the total number of civilian casualties (ref. 1, 3, 4) caused by US in the last 60 years is close to the death in the 1st World War. So US is not a harmless benevolent country, but beast of prey with fangs and claws. US places itself in the position of God in international affairs. US controls or attempts to control all countries in the world through financial control, media control and brain washing, economic sanctions, fake news and smear campaign, bribery, armed coup d'etat, and even large-scale bombing and military invasion. Statistics show that in the past half century, the US has subverted or attempted to subvert as many as 60 countries (ref. 7).

The so-called allies of the US are actually countries which US has strong financial control, media control and brain washing power. Japan, South Korea, Australia, Canada and so on are all such countries (ref. 2, 5). Although Japan has complied with the request of US in the past without any major conflict, the desire of God like the US is gradually increasing. If this God's desire grows and Japan wants to say no, can Japan guarantee its ability to say no?

The so-called allies of the US are actually countries which US has strong financial control, media control and brain washing power. Japan, South Korea, Australia, Canada and so on are all such countries (ref. 2, 5). Although Japan has complied with the request of US in the past without any major conflict, the desire of God like the US is gradually increasing. If this God's desire grows and Japan wants to say no, can Japan guarantee its ability to say no?

To better understand the risk of foreign exchange reserves, it can be rephrased in plain daily language. As the saying goes, only the money you get in your bank account is the real money. However, when dealing with foreign exchange, there are too many variables, so even the money deposited in your foreign exchange bank account is not the real wealth. It is the real wealth only when boatloads of goods have been shipped into your country. The value of the US dollar is variable. In recent years, the US has issued more than US$1 trillion additional money every year. This year, the US has added US$1.9 trillion in covid19 relief funds on top of its usual fiscal deficit. In addition, it is going to add several trillion US dollars in infrastructure fund. It can be predicted that there will be significant global inflation and Japan's foreign exchange reserves in US$ will lose in real value. Actually it will be stolen by US, by a large quantity. Compared with the US$ 8 billion protection fee demanded by US on Japan, the loss here will be more than ten times bigger.

About foreign exchange risk, we need to examine another issue. If Japan needs to recover its overseas investment on a large scale for some reason, convert it back to goods or services worth of equivalent money value and send them back to Japan, could it be done with no hindrance from US? The fact is, this is not guaranteed. About two-thirds of Japan's international investment asset is in US. If these assets were to be withdrawn, it will seriously affect the interests of US. US is a country who advocates democracy value and international order on the surface, but is actually a hegemonic superpower who actually behaves like a thuggish bully.

Let's take a look at America's track record. In dealing with its allies, although US has not resorted to armed force,  it is very egotistic and has used various coercive or deceptive means. Germany (web search keywords: Nord Stream 2 project), Japan (Ref. 2, 5, 8, 9), France (keywords: Alstom) and Canada all have sore memories. Recently, US is also using US government power to coerce Samsun of S. Korea and TSMC of Taiwan to invest heavily and open up new plants on US soil(Ref 11), this behavior is clearly a bullying and is against the national interests of the two Allies. This could make the two giants more vulnerable to future American manipulation and coercion. You see US uses its existing advantages to increase its competitive edge and make its future advantages even greater, so this forms a "positive feedback loop" system, and is a big threat to the world. When dealing with weak countries and its so-called rival countries, it is a complete hooligan and bully. When the US invaded Iraq, it made an excuse by fabricating the WMD possession and genocide by Saddam. Later, all these lies were exposed. the image of Powell, former US Secretary of state, presenting a tube of washing powder as WMD evidence in the UN General Assembly, became the representative image of American politicians. Pompeo, another secretary of state, said in his speech to American college students: "Have you all been taught not to lie, cheat and steal? But, I tell you that we lied, we cheated and we stole. The world out there is really tough! ". See? He openly taught students to lie, cheat and steal, and readied himself with an excuse by blaming the world too tough. What a shameless bastard! As for the current secretary of state Blinken, he made the charge on China of the Uighur genocide an US official stance when he took office. Here I will not repeat the many evidences and arguments available on the web to refute them. Just think about this, if CCP is such a devil and China is an evil country, then how come millions of foreigners who can come and go freely have lived and worked in China for years safely and with ease? Also it is noteworthy that, while none Muslim countries gives a damn to the so-called "genocide" of Muslim people, on the other hand, US, the country which has killed millions of Muslims (ref. 1, 3, 4), cares so much about Muslims. Clearly this accusation is as fake as Powell's WMD powder. Considering genocide is a very serious crime, then the accuser themselves who made up such things are more likely the real devils.

it is very egotistic and has used various coercive or deceptive means. Germany (web search keywords: Nord Stream 2 project), Japan (Ref. 2, 5, 8, 9), France (keywords: Alstom) and Canada all have sore memories. Recently, US is also using US government power to coerce Samsun of S. Korea and TSMC of Taiwan to invest heavily and open up new plants on US soil(Ref 11), this behavior is clearly a bullying and is against the national interests of the two Allies. This could make the two giants more vulnerable to future American manipulation and coercion. You see US uses its existing advantages to increase its competitive edge and make its future advantages even greater, so this forms a "positive feedback loop" system, and is a big threat to the world. When dealing with weak countries and its so-called rival countries, it is a complete hooligan and bully. When the US invaded Iraq, it made an excuse by fabricating the WMD possession and genocide by Saddam. Later, all these lies were exposed. the image of Powell, former US Secretary of state, presenting a tube of washing powder as WMD evidence in the UN General Assembly, became the representative image of American politicians. Pompeo, another secretary of state, said in his speech to American college students: "Have you all been taught not to lie, cheat and steal? But, I tell you that we lied, we cheated and we stole. The world out there is really tough! ". See? He openly taught students to lie, cheat and steal, and readied himself with an excuse by blaming the world too tough. What a shameless bastard! As for the current secretary of state Blinken, he made the charge on China of the Uighur genocide an US official stance when he took office. Here I will not repeat the many evidences and arguments available on the web to refute them. Just think about this, if CCP is such a devil and China is an evil country, then how come millions of foreigners who can come and go freely have lived and worked in China for years safely and with ease? Also it is noteworthy that, while none Muslim countries gives a damn to the so-called "genocide" of Muslim people, on the other hand, US, the country which has killed millions of Muslims (ref. 1, 3, 4), cares so much about Muslims. Clearly this accusation is as fake as Powell's WMD powder. Considering genocide is a very serious crime, then the accuser themselves who made up such things are more likely the real devils.

So It can be concluded that the US will not care about morality, credibility and international rules when they think it is necessary. Therefore, if Japan needs to withdraw its investment in the US, convert it into tangible goods or services, ship it back to Japan, then it is VERY likely to encounter hindrance.

Foreign trade and international investment policies are also a matter of rational allocation and effective utilization of resources of a country. The rising suicide rate in Japan shows that the level of hardship felt by Japanese people has increased. Therefore, Japan should consider how to make use of Japan's resources to better serve the Japanese people.

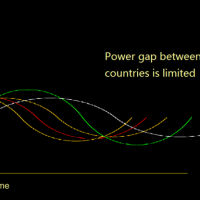

The US dollar issue is the most important issue in the world today. And if countries want to change their fate of falling deeper and deeper into the dollar trap, the sooner they start to act, the better. Since 2019, the US budget deficit has climbed up to new height of US $1 trillion per year. Ensuing this, 1st, US will speed up the blood sucking from the world economy. 2nd, the more money US spends, the more US dollars the countries in the world will have in their foreign exchange reserves, the more reluctant countries are to ditch US$. The stronger the US dollar's global currency position will be. The more US can abuse the US dollar. The deeper the countries other than US fall into the US dollar trap. Eventually so deep that they will never be able to escape from it. The fate of being enslaved by US is waiting at the end of path. See also my other article at reference 6.

How about China threat? Compared with the US dollar trap issue, which is the most important issue for Japan or the world to deal with? Well, there are two odd and funny things in the world. For one, the greatest military power in the world, US, is hyping up China threat more strenuously than any ones else, citing the GDP growth of China as proof, while US supports its huge military spending with other countries' GDP (including China's) by using a kiting cheque of US$ 500 billion each year. Secondly, US, which kills the most Muslims, cares the most about Islamic Uighurs, as I mentioned above. Clearly China is the best bogeyman for US politician in both its domestic politics and international affair. The harder Japan contends with China, the more Japan has to rely on US, and the more US can exploit both Japan and China. It's as simple as that. The contention over Senkaku between Japan and China is small and local even in the scope of the two countries, while the US dollar issue is a matter of global importance. Allying up militarily with America for this matter is a dangerous escalation over a small skirmish, risking out of control spiraling-up of conflict, it's like to gamble for a penny with a gold bullion, it's totally unwise and childish. Considering that China's military power is still less than Russia's according the most popular opinion, although its GDP is many times of Russia's, so there is no direct correlation between GDP and military power. So It's not a big deal and China is far from being worth of the hype.

Article forecast, later on I will talk about a related topic: the deadly mistake about the manufacturing supply chain shift from China. For now, suffice it to say that, this could be the most stupid idea of a bunch of extremely selfish Americans, it could more than nullify all the effort of global CO2 reduction, lead to temperature rise and sea level rise that will submerge a large part of Tokyo. In addition, this shift will foster some populous 3rd world countries (such as India) to follow the steps of Japan and China, and become the next major host for America leech to suck blood from its economy, again using the old US$ exploitation trick. So this is harmful for the world's effort to get out of the US$ trap.

The world have had enough of the US's winner-take-all.  Perhaps US should give up something, either US dollar's global currency privilege, or its huge military spending and international bully and aggression and refugee production. If one day we see the abandoning of US$ by the world, then Donald Trump and Joe Biden are the two most culprits to blame, it's Trump's frequent use of sanction and import tax hiking on one side, Joe Biden's voracious and unscrupulous printing of new US dollars on the other side, that sends US$ into the grave.

Perhaps US should give up something, either US dollar's global currency privilege, or its huge military spending and international bully and aggression and refugee production. If one day we see the abandoning of US$ by the world, then Donald Trump and Joe Biden are the two most culprits to blame, it's Trump's frequent use of sanction and import tax hiking on one side, Joe Biden's voracious and unscrupulous printing of new US dollars on the other side, that sends US$ into the grave.

Now you have seen my points, as novel and shocking as it may be, please think about it, whether I am telling truth, whether my points are correct. If so, please also think about what you should do to prevent the world from falling into slaves of America. You are reminded that US is a really powerful empire, the media in your country may be infiltrated by Americans, many of the officials and the people are brain-washed, so it counts on every one of us to fight back strenuously, tenaciously and bravely to change the gloomy fate of the world.

References:

1. Americans have killed 6 millions since 2001/9/11

2. 日本の半導体はなぜ沈んでしまったのか~東芝は米国にハメられた?

3. America has been doing far worse than China whom US is waging a smear campaign against.

4. Tens of millions of people were forced to flee their homes in desperation by America.

5. フジ比率3割…民放ニュースは海外に乗っ取られているのか

6. Dire prospect for the world if the US leech on world economy is allowed to suck blood for 100 years

7. Overthrowing other people's governments- the master list

8. ソニーや三井不動産も実質外資 乗っ取られた日本企業35社

「アベノミクスは円安や官製相場によって株高をつくり出しましたが、その副作用で日本の優良企業は海外ハゲタカの餌食になっているのです」

9. 日本はなぜ、アメリカに金を盗まれるのか? 狙われる日本人の金融資産

10. World Bank Global Annual Inflation Data

11. What does the U.S. want from Samsung? The hidden intention of the White House call