"The current world and Japan's economy"

(RESUME)

(Professor of international departments of Wayo Women's University,

Kageaki Yamashita)

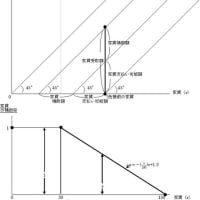

1. The impact of high interest rates in the US on countries other than the United States

funds flow out to the United States → currency value↓ → price↑(Southeast Asia etc.) → monetary tightening→ economy of countries other than the United States↓

currency value↓ → repayment burden of borrowing by dollar, euro or yen↑

→ bad debts of banks of developed countries↑ → credit crunch → developed country economy↓

(1) Turkey

Turkey has a low savings rate → Turkish banks and corporations depend on borrowing foreign currency loans from overseas banks.

→ interest rate in the United States↑(2015 December ~), President of Turkey hates monetary tightening → pressure to central bank → outflow of funds↑ → lira↓

● Turkey is a current account deficit country (→ foreign currency reserves are small), the US raises tariffs on aluminum and steel imports from Turkey (→ current account deficit↑)→ foreign exchange intervention is difficult →Lira depreciation

foreign exchange reserves (which can be repayment resources) <foreign debt (four times as much as foreign reserves) → debt repayment is not easy.

● Foreign currency reserve =" "assets" denominated in foreign currencies that central banks and governments have stored in preparation for settlement of import charges and payment of foreign debt. It is also a source of funds for implementing domestic currency buying intervention in the foreign exchange market. held in bonds, deposits, gold.

①Impact on domestic economy

(→ import price↑ →) inflation (→ consumption↓), repayment burden of foreign currency denominated debt↑ (→ corporate bankruptcy↑), overseas funds outflow (→ investment to Turkey decreases), citizen purchase foreign currency (→ If they use foreign currency as a means of settlement, monetary policy will be ineffective)

②Impact on European economy

repayment burden of foreign currency denominated debt↑ →bad debts of European bank↑ → loss of European bank with a large number of credit to Turkey (maximum is Spain)↑ → European banks' credit crunch → European economy↓

→ Euro selling → Euro ↓

③Impact on Japanese economy

lira depreciation, euro depreciation → yen appreciation → Japan's exports↓

and Turkish shock → world economy↓→ stock price↓ → consumption↓ → Japanese economy↓ (← scope of monetary easing and fiscal expenditure in Japan is limited)

(<strong>Argentina

inflation pressure and anxiety about repayment ability→ Argentine peso depreciation → driven to urgent rate hike → economy↓ → repayment of debt becomes difficult.

foreign debt of Turkey and Argentina = 40 to 50% of GDP)

(2)China

①Impact of trade war and US interest rate hike

US - China trade war (full - fledged from July) → production↓, anxiety about trade war → RMB(Chinese currency)↓, stock price↓

RMB ↓ → possibility of capital outflow↑

②US rate hike → RMB depreciation

economic slowdown, (US interest rate↑→) US-China interest rate difference↓ → RMB↓ → export↑, but the possibility of capital outflow↑ → further RMB↓

(It is possible to take measures of speculation suppression and capital regulation against excessive RMB depreciation)

③Problem of excessive debt

for domestic and foreign countries excessive loans → difficult to repay

④Reduction of excess debt

Government alerts the bubble → reduce excessive debt (of local governments and state-owned enterprises) (guidance to scrutinize banks' loan destination) → (bankruptcy of net finance → loss of individual investors →) consumption↓, (low profitable infrastructure financing↓ →) investment slump

tighten the shadow bank. small and medium-sized companies and part of local government-affiliated companies suffer from financing.

⑤The Belt and Road Initiative

Many countries borrow from China due to The Belt and Road Initiative vision of China.

Central Asia etc. depend on borrowing from China to fund resource development and infrastructure construction

→ however, they can not return their debts →They will transfer the right to operate infrastructure and resources development rights to China.

2. Economic crisis

● The economic crisis occurs with debt↑. The currency crisis is caused by borrowing foreign currency from foreign countries.

● Economic downturn → low interest → debt ↑ → bubble → but not repayable

→ bubble collapse → Economy ↓

● Emerging countries borrow funds from overseas with dollars or euros → in case of trade deficit currency value↓

→ payment burden ↑

● globalization, conversion of industrial structure → (gap between rich and poor) → (US) rate hike and import restrictions

import restrictions → exports of emerging countries to the US↓ (→ trade deficit ↑) → currency value of emerging countries↓

● prior to the war protection trade began after the Great Depression.

Currently, there is a possibility that the economic crisis will come after protection trade begins.

#economy #world economy #Turkey #china

(RESUME)

(Professor of international departments of Wayo Women's University,

Kageaki Yamashita)

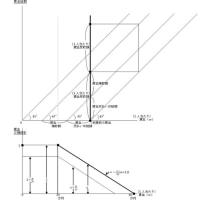

1. The impact of high interest rates in the US on countries other than the United States

funds flow out to the United States → currency value↓ → price↑(Southeast Asia etc.) → monetary tightening→ economy of countries other than the United States↓

currency value↓ → repayment burden of borrowing by dollar, euro or yen↑

→ bad debts of banks of developed countries↑ → credit crunch → developed country economy↓

(1) Turkey

Turkey has a low savings rate → Turkish banks and corporations depend on borrowing foreign currency loans from overseas banks.

→ interest rate in the United States↑(2015 December ~), President of Turkey hates monetary tightening → pressure to central bank → outflow of funds↑ → lira↓

● Turkey is a current account deficit country (→ foreign currency reserves are small), the US raises tariffs on aluminum and steel imports from Turkey (→ current account deficit↑)→ foreign exchange intervention is difficult →Lira depreciation

foreign exchange reserves (which can be repayment resources) <foreign debt (four times as much as foreign reserves) → debt repayment is not easy.

● Foreign currency reserve =" "assets" denominated in foreign currencies that central banks and governments have stored in preparation for settlement of import charges and payment of foreign debt. It is also a source of funds for implementing domestic currency buying intervention in the foreign exchange market. held in bonds, deposits, gold.

①Impact on domestic economy

(→ import price↑ →) inflation (→ consumption↓), repayment burden of foreign currency denominated debt↑ (→ corporate bankruptcy↑), overseas funds outflow (→ investment to Turkey decreases), citizen purchase foreign currency (→ If they use foreign currency as a means of settlement, monetary policy will be ineffective)

②Impact on European economy

repayment burden of foreign currency denominated debt↑ →bad debts of European bank↑ → loss of European bank with a large number of credit to Turkey (maximum is Spain)↑ → European banks' credit crunch → European economy↓

→ Euro selling → Euro ↓

③Impact on Japanese economy

lira depreciation, euro depreciation → yen appreciation → Japan's exports↓

and Turkish shock → world economy↓→ stock price↓ → consumption↓ → Japanese economy↓ (← scope of monetary easing and fiscal expenditure in Japan is limited)

(<strong>Argentina

inflation pressure and anxiety about repayment ability→ Argentine peso depreciation → driven to urgent rate hike → economy↓ → repayment of debt becomes difficult.

foreign debt of Turkey and Argentina = 40 to 50% of GDP)

(2)China

①Impact of trade war and US interest rate hike

US - China trade war (full - fledged from July) → production↓, anxiety about trade war → RMB(Chinese currency)↓, stock price↓

RMB ↓ → possibility of capital outflow↑

②US rate hike → RMB depreciation

economic slowdown, (US interest rate↑→) US-China interest rate difference↓ → RMB↓ → export↑, but the possibility of capital outflow↑ → further RMB↓

(It is possible to take measures of speculation suppression and capital regulation against excessive RMB depreciation)

③Problem of excessive debt

for domestic and foreign countries excessive loans → difficult to repay

④Reduction of excess debt

Government alerts the bubble → reduce excessive debt (of local governments and state-owned enterprises) (guidance to scrutinize banks' loan destination) → (bankruptcy of net finance → loss of individual investors →) consumption↓, (low profitable infrastructure financing↓ →) investment slump

tighten the shadow bank. small and medium-sized companies and part of local government-affiliated companies suffer from financing.

⑤The Belt and Road Initiative

Many countries borrow from China due to The Belt and Road Initiative vision of China.

Central Asia etc. depend on borrowing from China to fund resource development and infrastructure construction

→ however, they can not return their debts →They will transfer the right to operate infrastructure and resources development rights to China.

2. Economic crisis

● The economic crisis occurs with debt↑. The currency crisis is caused by borrowing foreign currency from foreign countries.

● Economic downturn → low interest → debt ↑ → bubble → but not repayable

→ bubble collapse → Economy ↓

● Emerging countries borrow funds from overseas with dollars or euros → in case of trade deficit currency value↓

→ payment burden ↑

● globalization, conversion of industrial structure → (gap between rich and poor) → (US) rate hike and import restrictions

import restrictions → exports of emerging countries to the US↓ (→ trade deficit ↑) → currency value of emerging countries↓

● prior to the war protection trade began after the Great Depression.

Currently, there is a possibility that the economic crisis will come after protection trade begins.

#economy #world economy #Turkey #china

※コメント投稿者のブログIDはブログ作成者のみに通知されます