追補

「国家への挑戦」リブラ潰し鮮明に G20

2019.10.19

18日閉幕した20カ国・地域(G20)財務相・中央銀行総裁会議で、議長国・日本は、米フェイスブックの暗号資産(仮想通貨)「リブラ」に主要国が厳しく対処すべきだとの論調をとりまとめた。成果文書では、国家が発行する通貨に代わる「通貨主権にかかわる問題」が生じかねない側面に踏み込み言及。リブラを早期発行させる同社の計画は風前のともしびだ。

フェイスブックが公表した構想によると、リブラはドルなどの通貨をはじめとする金融資産で価値を担保した「ステーブルコイン」と呼ばれる種類の仮想通貨だ。投機性の高さが問題視された「ビットコイン」などとは性格が異なる。

合意文書では、通貨を発行する権限を独占する「通貨主権」が、リブラの浸透により侵されかねないとの懸念を踏まえ、G20が国際通貨基金(IMF)に問題点を調査するよう依頼。G20内の厳しい警戒感が浮き彫りになった。

リブラは利用者が送金・決済をスマートフォンで手軽にでき、急速に普及する可能性がある。リブラによって「自国通貨の信用が損なわれ、駆逐されるとの懸念が小国にあった」(財務相同行筋)。リブラが乗り越えるべき課題は、犯罪などへの流用のリスク対処だけでは済みそうにない。

高まる包囲網に対抗し、フェイスブック側もリブラ責任者のデビッド・マーカス氏を16日のIMFの関連イベントに出席させ、懸念払拭につとめた。運営団体から米クレジットカード大手ビザなどが離脱したが、マーカス氏は強気の姿勢を貫き、「現状維持は選択肢ではない」などと述べ、欧米各国が中国などに先を越される危機感もあおった。

フェイスブックは各国の規制当局と足並みをそろえ発行に向けた準備を進める方針だが、議長国として開いた記者会見で、日銀の黒田東彦総裁は「(関連規制の)検討中に発行するのは許されない」と断じた。

同社のザッカーバーグ最高経営責任者(CEO)は近く米議会で証言する予定で、発言が注目される。(ワシントン 塩原永久)

貧困層の支援ができる。世界には銀行口座をもてず、金融の恩恵がおよばない人が大勢いる。途上国から外国に働きに出た人が故郷に送金する手数料が高い。

Libra協会は仮想通貨交換業者などを認定再販業者に設定許可する。正式メンバーだけがノードを持てる。現在ノード運営能力をもつメンバーは Vodafone、Mastercard、Visa、Stripe、Uber、Spotifyなど28社に限られている。それら業者を通じて、ユーザーに対してLibraの販売や法定通貨の払い戻しを行う。通貨の価値は、信頼できる複数の通貨バスケットと連動する。1単位のリブラは約1ドル。銀行と中央銀行の関係と同じだ。リザーブをレイズするために発行される投資家トークンは証券性を持ち、セキュリティトークンに分類されるが、Libra通貨の方セキュリティトークン扱いされない。利子もつかない。つまり一般人の目にするLibra通貨は分散ブロックチェーンではない。ただの電子的債権債務の記録(紙でない紙幣)である。価値は初めこそ担保を求めるが、自己実現的に電子的に発行増殖しても支障は生じない。

libraで世界の貧困は解決する のか?貧困 金融弱者ゆえの正義

こういうやり方が常套手段。こんな程度のメリットと引き換えに中央銀行のシニョリッジ益を法定外非課税無国籍者にシェアしてしまうのは愚か以上に国家反逆罪である。これが許されているのはそのやり方に法定の罪がないという理由だけである。誰にも規制されない通貨の連合は基軸通貨を暴落させ国際決済を狂わせ、経常収支の混乱を経て国民国家を危機に陥れる。

開発者Marcus《「Libraの恩恵を得るためにFacebookを信頼する必要はない。また、FacebookはLibra Networkに対していかなる特別な責任を担うこともない」とMarcus氏は述べている。

Facebookは「Calibra」と呼ばれるLibra向けのデジタルウォレットも開発している。デジタルウォレットはMessenger、WhatsApp、および専用アプリで使用することができる。

米国時間7月2日、Economic Policy Institute(EPI) や米国公共利益調査グループ(U.S. PIRG)を含む30超の団体と、民主党議員5人がそれぞれFacebookに書簡を送付し、新しい暗号通貨の開発計画を一時停止するよう要請した。》

06:47 12.07.2019

The People's Bank of China is speeding up work on creating its own cryptocurrency. This was stated during a seminar at Peking University's Institute of Digital Finance by the head of the research division of the Chinese Central Bank, Wang Xin.

According to the head of the People's Bank of China research bureau, the development program of the "digital yuan" has already been approved by the State Council of the People's Republic of China. Commercial structures are also involved in the development of a crypto yuan, in order for the new product to be competitive in the market.

The official from the Central Bank of China noted that the financial regulator is closely following the development of the global cryptocurrency Libra, which was recently announced by Facebook. Earlier, Mu Changchun, a deputy head of the People's Bank of China's Payment and Settlement Department, in an article published in Caixin Weekly, said that cryptocurrencies, including Libra, should be regulated by central banks. It is likely that the very possibility of the emergence of a truly international means of payment stimulates the authorities of the PRC to accelerate with their own developments in order not to miss the opportunity to take an active part in the formation of a new global financial system.

In fact, the Chinese authorities have been talking about developing their own cryptocurrency for years. The People's Bank of China already owns 78 patents in the field of cryptocurrencies and another 44 patents related to blockchain technology. Earlier, Deputy Governor at the People's Bank of China Fan Yifei noted that the digital yuan would eventually have to replace the monetary aggregate M0 (cash in circulation). The gradual abandonment of cash is an obvious global trend, which is most clearly seen in China, where mobile payments already prevail in the daily settlements of citizens. Therefore, it is quite logical to assume that the Chinese authorities are planning to create a full-fledged digital analogue of the fiat yuan.

Until recently, there was little information about how work was progressing to create China’s own crypto yuan. But after Facebook published the White Paper on Libra, Chinese officials became more active. The fact is that Libra, announced by Facebook, is very different both technically and conceptually from other cryptocurrencies, in particular, Bitcoin. Libra will be managed by a consortium of dozens of major financial and technology companies, including Visa, MasterCard, PayPal, eBay, Uber, and Lift. This consortium will be responsible for processing and issuing a new cryptocurrency. Libra is a stable block that will be provided with reliable assets - deposits and securities. Moreover, it will be provided by not only one country but several countries with reliable currencies. That is, in fact, Libra is conceived as a supranational means of payment. The closest analogue is special drawing rights (SDR). However, unlike SDR, Libra should be an absolutely liquid medium of exchange, using which cross-border payments will be available to the vast majority of the world's population and take a matter of seconds.

After the Global Financial Crisis in 2008, China offered to create a new global reserve currency based on SDR, which would help get rid of dependence on the dollar. Therefore, the Libra concept as a whole is appealing to China, Liu Dongmin, head of the International Finance Division at the Institute of World Economics and Policy at the Chinese Academy of Social Sciences, said.

“If we talk from the point of view of maintaining the stability of the international monetary system, supranational currencies as the main means of international payments are a relatively good solution. Compared to any sovereign currency, such currency will better cope with the task of ensuring global financial stability. However, at the moment, such projects have not yet been implemented”.

The hegemony of the dollar in international payments does not suit many countries, including China. However, pegging prices for various goods and services in international trade to a single currency - the US dollar - was convenient. The concept of Libra, on the one hand, is fair, but on the other hand, it can create a lot of problems. For example, Facebook’s White Paper says that Libra can be easily converted into flat currency. But the participants of the managing consortium are private companies that are physically unable to provide a sufficient amount of cash liquidity. Only central banks have such capability. Therefore, for the normal functioning of Libra, the participation of financial regulators is necessary, Liu Dongmin said.

“It is necessary that the central banks of different countries develop regulatory measures for Libra. It is especially required if this cryptocurrency will be promoted as a means of payment throughout the world. Because, any global currency, on whatever principles it was founded, will still have a certain impact on the currency sovereignty and financial security of individual countries. For example, with regard to currency sovereignty - the world cryptocurrency can become a substitute for the weak currencies of some countries and can gradually oust them. People will try to pay in more stable world currency, and this will put even more pressure on the exchange rate of national currencies”.

Preserving the sovereignty of the national currency can be much more effective if you create a digital national currency that meets current trends in the development of finance, the expert noted. If China launches a digital yuan, it will be the first national cryptocurrency in the world, provided with a stable fiat currency. There have already been attempts to create a national cryptocurrency – Venezuela, for example, launched El Petro, backed by oil assets. However, given the state of the Venezuelan economy, El Petro can hardly claim to be an international means of payment. With the digital yuan, the situation is different. The crypto yuan emitted by the Chinese Central Bank, having all the technical advantages of cryptocurrency, can earn trust in world markets and significantly increase the level of internationalisation of the Chinese currency. And if Libra or another similar supranational currency is launched, China, given its experiences and capacities, will be able to influence the formation of the rules for the functioning of the new international financial system.

The views expressed in this article are those of the speaker and do not necessarily reflect those of Sputnik.

《仮想通貨取引所バイナンスの戦略担当者ジン・チャオ氏は、フェイスブックの仮想通貨リブラについて「非常に興奮している」と語り、同取引所へのリブラ上場についてフェイスブックが公式に協議していることを明かした。》

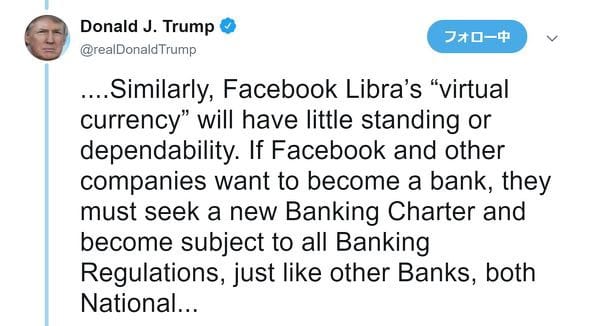

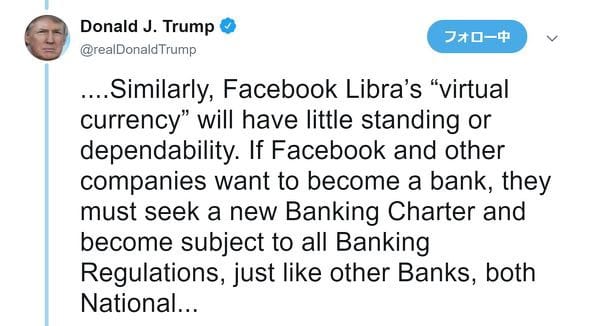

《連邦準備制度の議長であるパウエル氏は最近、彼のチームがデジタル製品に対する最良の規制措置を決定するために #Libra を綿密に研究していた。イングランド銀行総裁のMark Carneyは、英国政府はLibraに対して「オープンマインドだが扉は閉ざす」べきだと考えている。》

Does Facebook’s Libra Token Really Pose a Threat to the Central Banks of the World?

By Shiraz J - 6 days ago

Jerome Powell, the Chairman of the Federal Reserve, was recently quoted as saying that he and his team was closely studying Libra in order to determine the best course of regulatory action for the digital offering.

Governor of the Bank of England, Mark Carney, is of the belief that the British government should have an ‘open mind but not an open door’ towards Libra.

As per a recent op-ed piece penned by former World Bank Chief Economist ‘Kaushik Basu’, FBs much-hyped crypto offering ‘Libra’ has the potential to completely make national currencies (such as the US Dollar, Euro, Rupee) ineffective and essentially worthless.

Expounding his thoughts on the subject, Basu was quoted as saying:

“…monetary policymakers should be especially worried, because they may find it much harder to control unemployment and inflation in a Libra world.”

A Closer Look at the Situation

In Basu’s article he states that as we move into the future, Facebook users may start to adopt Libra at a scale where national currencies may be rendered useless.

Not only that, Basu also points out that as inflation rises, Facebook’s money creation powers will also surge quite substantially — thus, it is important that the asset be regulated in a manner that allows for the healthy growth of the global finance engine.

“…We may then need new laws and global treaties to mitigate potential negative fallout and curb the power of the organizations that run these new currencies.”

The ex-World Bank executive believes that banning Libra will not yield any fruitful results rather it will make people even more suspicious of central banks than they already are.

Jerome Powell — Chairman of the Federal Reserve — recently gave an interview in which he indicated that his team was looking at crypto assets ‘very carefully’ and that Libra will be held to extremely high regulatory standards because of the currency’s adoption potential.

Maxine Waters — Chairperson of the FSC — also indicated that Libra will most likely not be allowed to compete with the US dollar. In this regard, she has already chalked out a number of meetings that will look to dissect the ongoing Libra situation.

「国家への挑戦」リブラ潰し鮮明に G20

2019.10.19

18日閉幕した20カ国・地域(G20)財務相・中央銀行総裁会議で、議長国・日本は、米フェイスブックの暗号資産(仮想通貨)「リブラ」に主要国が厳しく対処すべきだとの論調をとりまとめた。成果文書では、国家が発行する通貨に代わる「通貨主権にかかわる問題」が生じかねない側面に踏み込み言及。リブラを早期発行させる同社の計画は風前のともしびだ。

フェイスブックが公表した構想によると、リブラはドルなどの通貨をはじめとする金融資産で価値を担保した「ステーブルコイン」と呼ばれる種類の仮想通貨だ。投機性の高さが問題視された「ビットコイン」などとは性格が異なる。

合意文書では、通貨を発行する権限を独占する「通貨主権」が、リブラの浸透により侵されかねないとの懸念を踏まえ、G20が国際通貨基金(IMF)に問題点を調査するよう依頼。G20内の厳しい警戒感が浮き彫りになった。

リブラは利用者が送金・決済をスマートフォンで手軽にでき、急速に普及する可能性がある。リブラによって「自国通貨の信用が損なわれ、駆逐されるとの懸念が小国にあった」(財務相同行筋)。リブラが乗り越えるべき課題は、犯罪などへの流用のリスク対処だけでは済みそうにない。

高まる包囲網に対抗し、フェイスブック側もリブラ責任者のデビッド・マーカス氏を16日のIMFの関連イベントに出席させ、懸念払拭につとめた。運営団体から米クレジットカード大手ビザなどが離脱したが、マーカス氏は強気の姿勢を貫き、「現状維持は選択肢ではない」などと述べ、欧米各国が中国などに先を越される危機感もあおった。

フェイスブックは各国の規制当局と足並みをそろえ発行に向けた準備を進める方針だが、議長国として開いた記者会見で、日銀の黒田東彦総裁は「(関連規制の)検討中に発行するのは許されない」と断じた。

同社のザッカーバーグ最高経営責任者(CEO)は近く米議会で証言する予定で、発言が注目される。(ワシントン 塩原永久)

貧困層の支援ができる。世界には銀行口座をもてず、金融の恩恵がおよばない人が大勢いる。途上国から外国に働きに出た人が故郷に送金する手数料が高い。

Libra協会は仮想通貨交換業者などを認定再販業者に設定許可する。正式メンバーだけがノードを持てる。現在ノード運営能力をもつメンバーは Vodafone、Mastercard、Visa、Stripe、Uber、Spotifyなど28社に限られている。それら業者を通じて、ユーザーに対してLibraの販売や法定通貨の払い戻しを行う。通貨の価値は、信頼できる複数の通貨バスケットと連動する。1単位のリブラは約1ドル。銀行と中央銀行の関係と同じだ。リザーブをレイズするために発行される投資家トークンは証券性を持ち、セキュリティトークンに分類されるが、Libra通貨の方セキュリティトークン扱いされない。利子もつかない。つまり一般人の目にするLibra通貨は分散ブロックチェーンではない。ただの電子的債権債務の記録(紙でない紙幣)である。価値は初めこそ担保を求めるが、自己実現的に電子的に発行増殖しても支障は生じない。

libraで世界の貧困は解決する のか?貧困 金融弱者ゆえの正義

こういうやり方が常套手段。こんな程度のメリットと引き換えに中央銀行のシニョリッジ益を法定外非課税無国籍者にシェアしてしまうのは愚か以上に国家反逆罪である。これが許されているのはそのやり方に法定の罪がないという理由だけである。誰にも規制されない通貨の連合は基軸通貨を暴落させ国際決済を狂わせ、経常収支の混乱を経て国民国家を危機に陥れる。

開発者Marcus《「Libraの恩恵を得るためにFacebookを信頼する必要はない。また、FacebookはLibra Networkに対していかなる特別な責任を担うこともない」とMarcus氏は述べている。

Facebookは「Calibra」と呼ばれるLibra向けのデジタルウォレットも開発している。デジタルウォレットはMessenger、WhatsApp、および専用アプリで使用することができる。

米国時間7月2日、Economic Policy Institute(EPI) や米国公共利益調査グループ(U.S. PIRG)を含む30超の団体と、民主党議員5人がそれぞれFacebookに書簡を送付し、新しい暗号通貨の開発計画を一時停止するよう要請した。》

06:47 12.07.2019

The People's Bank of China is speeding up work on creating its own cryptocurrency. This was stated during a seminar at Peking University's Institute of Digital Finance by the head of the research division of the Chinese Central Bank, Wang Xin.

According to the head of the People's Bank of China research bureau, the development program of the "digital yuan" has already been approved by the State Council of the People's Republic of China. Commercial structures are also involved in the development of a crypto yuan, in order for the new product to be competitive in the market.

The official from the Central Bank of China noted that the financial regulator is closely following the development of the global cryptocurrency Libra, which was recently announced by Facebook. Earlier, Mu Changchun, a deputy head of the People's Bank of China's Payment and Settlement Department, in an article published in Caixin Weekly, said that cryptocurrencies, including Libra, should be regulated by central banks. It is likely that the very possibility of the emergence of a truly international means of payment stimulates the authorities of the PRC to accelerate with their own developments in order not to miss the opportunity to take an active part in the formation of a new global financial system.

In fact, the Chinese authorities have been talking about developing their own cryptocurrency for years. The People's Bank of China already owns 78 patents in the field of cryptocurrencies and another 44 patents related to blockchain technology. Earlier, Deputy Governor at the People's Bank of China Fan Yifei noted that the digital yuan would eventually have to replace the monetary aggregate M0 (cash in circulation). The gradual abandonment of cash is an obvious global trend, which is most clearly seen in China, where mobile payments already prevail in the daily settlements of citizens. Therefore, it is quite logical to assume that the Chinese authorities are planning to create a full-fledged digital analogue of the fiat yuan.

Until recently, there was little information about how work was progressing to create China’s own crypto yuan. But after Facebook published the White Paper on Libra, Chinese officials became more active. The fact is that Libra, announced by Facebook, is very different both technically and conceptually from other cryptocurrencies, in particular, Bitcoin. Libra will be managed by a consortium of dozens of major financial and technology companies, including Visa, MasterCard, PayPal, eBay, Uber, and Lift. This consortium will be responsible for processing and issuing a new cryptocurrency. Libra is a stable block that will be provided with reliable assets - deposits and securities. Moreover, it will be provided by not only one country but several countries with reliable currencies. That is, in fact, Libra is conceived as a supranational means of payment. The closest analogue is special drawing rights (SDR). However, unlike SDR, Libra should be an absolutely liquid medium of exchange, using which cross-border payments will be available to the vast majority of the world's population and take a matter of seconds.

After the Global Financial Crisis in 2008, China offered to create a new global reserve currency based on SDR, which would help get rid of dependence on the dollar. Therefore, the Libra concept as a whole is appealing to China, Liu Dongmin, head of the International Finance Division at the Institute of World Economics and Policy at the Chinese Academy of Social Sciences, said.

“If we talk from the point of view of maintaining the stability of the international monetary system, supranational currencies as the main means of international payments are a relatively good solution. Compared to any sovereign currency, such currency will better cope with the task of ensuring global financial stability. However, at the moment, such projects have not yet been implemented”.

The hegemony of the dollar in international payments does not suit many countries, including China. However, pegging prices for various goods and services in international trade to a single currency - the US dollar - was convenient. The concept of Libra, on the one hand, is fair, but on the other hand, it can create a lot of problems. For example, Facebook’s White Paper says that Libra can be easily converted into flat currency. But the participants of the managing consortium are private companies that are physically unable to provide a sufficient amount of cash liquidity. Only central banks have such capability. Therefore, for the normal functioning of Libra, the participation of financial regulators is necessary, Liu Dongmin said.

“It is necessary that the central banks of different countries develop regulatory measures for Libra. It is especially required if this cryptocurrency will be promoted as a means of payment throughout the world. Because, any global currency, on whatever principles it was founded, will still have a certain impact on the currency sovereignty and financial security of individual countries. For example, with regard to currency sovereignty - the world cryptocurrency can become a substitute for the weak currencies of some countries and can gradually oust them. People will try to pay in more stable world currency, and this will put even more pressure on the exchange rate of national currencies”.

Preserving the sovereignty of the national currency can be much more effective if you create a digital national currency that meets current trends in the development of finance, the expert noted. If China launches a digital yuan, it will be the first national cryptocurrency in the world, provided with a stable fiat currency. There have already been attempts to create a national cryptocurrency – Venezuela, for example, launched El Petro, backed by oil assets. However, given the state of the Venezuelan economy, El Petro can hardly claim to be an international means of payment. With the digital yuan, the situation is different. The crypto yuan emitted by the Chinese Central Bank, having all the technical advantages of cryptocurrency, can earn trust in world markets and significantly increase the level of internationalisation of the Chinese currency. And if Libra or another similar supranational currency is launched, China, given its experiences and capacities, will be able to influence the formation of the rules for the functioning of the new international financial system.

The views expressed in this article are those of the speaker and do not necessarily reflect those of Sputnik.

《仮想通貨取引所バイナンスの戦略担当者ジン・チャオ氏は、フェイスブックの仮想通貨リブラについて「非常に興奮している」と語り、同取引所へのリブラ上場についてフェイスブックが公式に協議していることを明かした。》

《連邦準備制度の議長であるパウエル氏は最近、彼のチームがデジタル製品に対する最良の規制措置を決定するために #Libra を綿密に研究していた。イングランド銀行総裁のMark Carneyは、英国政府はLibraに対して「オープンマインドだが扉は閉ざす」べきだと考えている。》

Does Facebook’s Libra Token Really Pose a Threat to the Central Banks of the World?

By Shiraz J - 6 days ago

Jerome Powell, the Chairman of the Federal Reserve, was recently quoted as saying that he and his team was closely studying Libra in order to determine the best course of regulatory action for the digital offering.

Governor of the Bank of England, Mark Carney, is of the belief that the British government should have an ‘open mind but not an open door’ towards Libra.

As per a recent op-ed piece penned by former World Bank Chief Economist ‘Kaushik Basu’, FBs much-hyped crypto offering ‘Libra’ has the potential to completely make national currencies (such as the US Dollar, Euro, Rupee) ineffective and essentially worthless.

Expounding his thoughts on the subject, Basu was quoted as saying:

“…monetary policymakers should be especially worried, because they may find it much harder to control unemployment and inflation in a Libra world.”

A Closer Look at the Situation

In Basu’s article he states that as we move into the future, Facebook users may start to adopt Libra at a scale where national currencies may be rendered useless.

Not only that, Basu also points out that as inflation rises, Facebook’s money creation powers will also surge quite substantially — thus, it is important that the asset be regulated in a manner that allows for the healthy growth of the global finance engine.

“…We may then need new laws and global treaties to mitigate potential negative fallout and curb the power of the organizations that run these new currencies.”

The ex-World Bank executive believes that banning Libra will not yield any fruitful results rather it will make people even more suspicious of central banks than they already are.

Jerome Powell — Chairman of the Federal Reserve — recently gave an interview in which he indicated that his team was looking at crypto assets ‘very carefully’ and that Libra will be held to extremely high regulatory standards because of the currency’s adoption potential.

Maxine Waters — Chairperson of the FSC — also indicated that Libra will most likely not be allowed to compete with the US dollar. In this regard, she has already chalked out a number of meetings that will look to dissect the ongoing Libra situation.